How the 2020 CARES Act Can Save Your Business Money

In March of 2020, the Federal government signed into effect the Coronavirus Aid, Relief, and Economic Security (CARES) Act. One of CARES’ purposes is to provide relief to businesses affected by the Coronavirus with accelerated tax savings on “qualified improvements” to their business properties.

Under Section 168 of the CARES Act, the cost of upgrades to your commercial fire sprinkler, fire alarm, special hazard, or security system may be fully deducted as a business expense if placed into service before the end of 2020. AFPG cares deeply about Life Safety and our customers, and we want to make sure all of you benefit from this opportunity to upgrade your Life Safety systems with maximum tax savings.

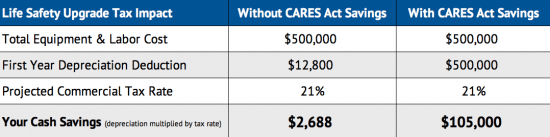

Your cash savings will come from your first year depreciation deduction. Your deduction would normally be spread out over 39 years. But under Section 168, you can now deduct the full equipment and labor cost the very first year – giving you accelerated cash savings.

How the 2020 CARES Act works:

Below are the benefits of Section 168 of the CARES Act, as it pertains to Life Safety System upgrades:

- Includes a full tax deduction for both the equipment and labor costs of Life Safety upgrades to commercial properties.

- Tax savings can be retroactive to any Life Safety upgrades performed after January 1, 2018.

- No maximum purchase amounts.

- Visit home.treasury.gov for more information on the CARES Act

To take advantage of this opportunity, please fill out our contact form here, and one of our Life Safety experts will contact you to discuss your options regarding the CARES Act.